Unleashing Out-of-Market Loan Opportunities

The Loan MarketPlace's Power in Loan Participation Placement

In the ever-evolving landscape of banking, seizing opportunities beyond traditional markets is essential for building trust and loyalty, facilitating client’s growth, enhancing the banks financial performance, and strengthening market positioning. However, originating loans out of market and securing participation from other financial institutions can be a daunting task fraught with challenges. Enter The Loan MarketPlace – your strategic partner in revolutionizing out-of-market loan participation placement.

Streamlined Partner Matching:

Gone are the days of manual partner search. The Loan MarketPlace offers bankers a streamlined approach to partner matching by leveraging advanced algorithms and comprehensive data analytics to connect your bank with potential participating banks. Whether you're originating loans in unfamiliar territories or seeking diverse capital sources, our platform expedites the partner identification process, saving you time and effort while maximizing opportunities.

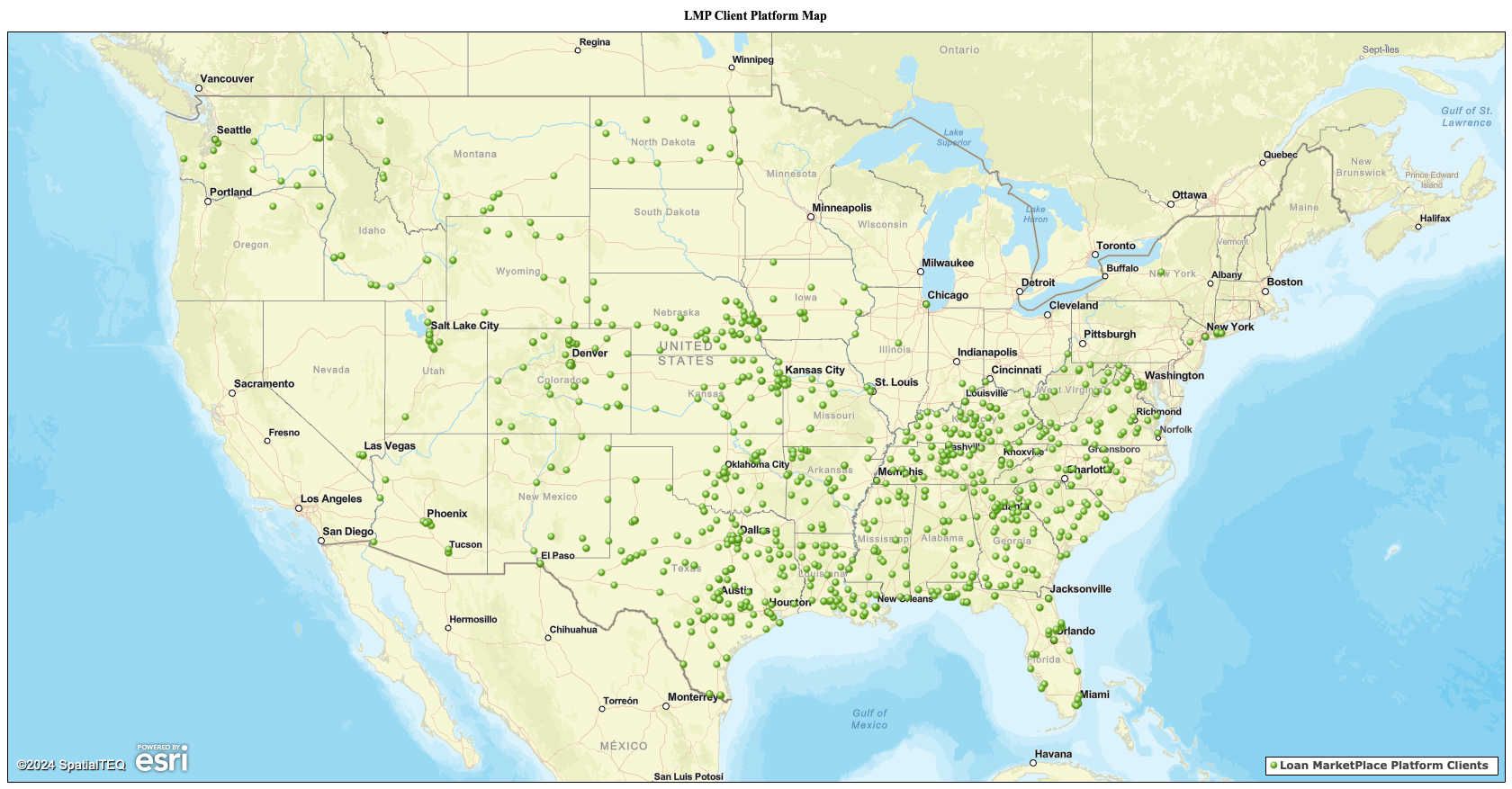

Expansive Connectivity:

Success in out-of-market loan participation placement hinges on strategic connectivity and expansive reach. The Loan MarketPlace delivers on both fronts, offering bankers access to a vast network of 1300+ participating banks spanning regions, industries, and asset classes. Whether you're seeking local partners in distant markets or exploring opportunities with niche lenders, our platform connects you with potential collaborators, enabling you to diversify your lending portfolio and capitalize on emerging market trends.

Strengthening Market Positioning:

Banks that actively support their CRE and C&I clients in out-of-market facility construction or purchase projects enhance their own market positioning and reputation. By being recognized as trusted advisors and reliable partners, banks can attract new clients, deepen existing relationships, and differentiate themselves in a competitive banking landscape. This positive brand perception can translate into sustainable business growth and heightened industry credibility over time.

Don’t let geographic walls impede taking care of CRE and C&I bank clients when they embark on out-of-market expansion, it is not just a gesture of goodwill – it's a strategic imperative for banks. By building trust, facilitating growth, mitigating risk, enhancing financial performance, and strengthening market positioning, banks can forge enduring relationships with their clients and position themselves as invaluable partners in their journey towards success.

The Loan MarketPlace - Examples of Recent Out of Market Transactions

- Bank financing niche hotels across a state, participated out 50% of each project.

- Bank financing assisted living facilities in multiple states, participated out 45% of each project.

- Bank financing storage facilities nationally, participated out 43% of each project.

- Bank financing C&I warehouses in multiple states, participated out 49% of each project.

- Bank selling hospitality portfolio in SE, participated 60% of each hotel.

- Bank financing Ag loans in multiple states, participating 35% of each project.

- Bank financing client 800K sq. ft. warehouse out of state project. Participated 55% of project.

- Bank financing dealer network in 8 states, participating 70% of loan portfolio.

Contact The Loan MarketPlace to discuss your out-of-market strategy and opportunities.