Find the Perfect Fit: Explore Selling Your Bank with Confidence

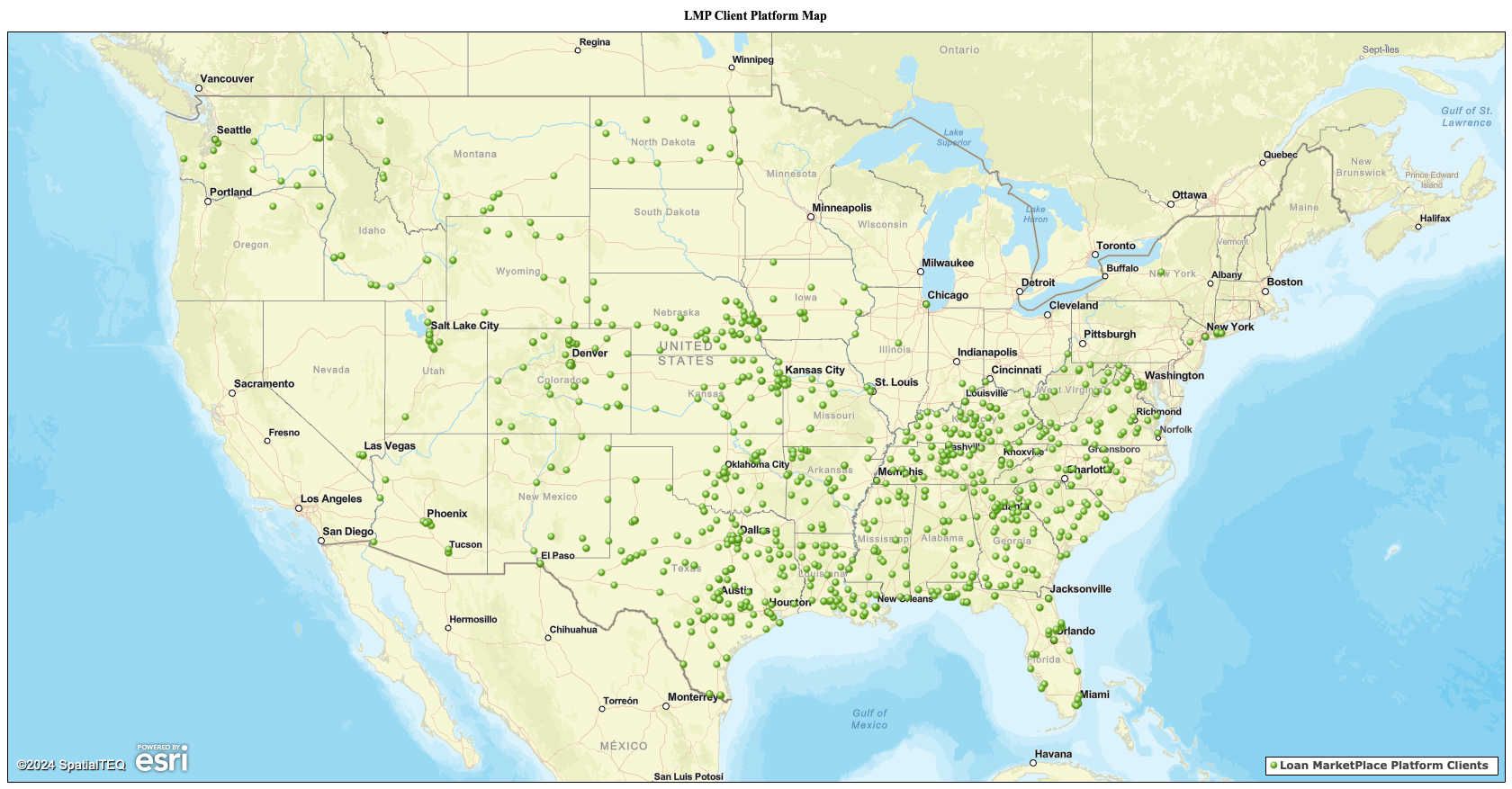

The Loan MarketPlace offers a compelling solution for banks contemplating the sale of their institution. With our extensive network and expertise in financial transactions, we provide a confidential seamless platform for connecting banks with potential buyers. By leveraging our specialized knowledge and comprehensive resources, banks can navigate the complex process of selling their institution with confidence. Our tailored approach ensures that each bank receives personalized attention and support throughout the entire transaction, from initial discussions to finalizing the deal. Moreover, partnering with The Loan MarketPlace offers banks access to a wide range of qualified buyers, maximizing the opportunity to secure favorable terms and value for their institution. With our proven track record of facilitating successful transactions, banks can trust us to deliver results and navigate the sale process efficiently and effectively.

Reasons to consider selling your bank:

Strategic Shift: The current owners or management might decide to exit the banking industry due to a strategic shift in their business focus. This could be driven by changes in market conditions, regulatory requirements, or a desire to reallocate resources.

Financial Performance: Poor financial performance or inability to meet regulatory capital requirements can lead to a decision to sell the bank. Financial difficulties may arise due to bad loans, operational inefficiencies, or economic downturns.

Regulatory Pressures: Regulatory changes or increased scrutiny from regulators can prompt a bank to seek a sale. Compliance costs and regulatory burdens may become too high for smaller or mid-sized banks to manage independently.

Economic Factors: Economic factors such as changes in interest rates, inflation, or market competition can impact a bank's profitability and make a sale more attractive to stakeholders.

Mergers and Acquisitions: Consolidation within the banking industry is common, driven by economies of scale, cost efficiencies, and market positioning. A bank may be put up for sale as part of a merger or acquisition strategy to strengthen its competitive position.

Ownership Changes: Changes in ownership structure, such as succession planning, family disputes, or shareholder pressure, may lead to a decision to sell the bank.

Strategic Partnership: Seeking a strategic partner or investor to inject capital, technology, or expertise into the bank's operations can be a reason for putting it up for sale. This might be driven by a desire to expand into new markets or offer new products and services.

Valuation: Owners or investors might believe that the bank is currently undervalued in the market, leading them to explore a sale to realize value for shareholders.

Market Conditions: Favorable market conditions, such as high demand for bank assets or attractive valuation multiples, may encourage owners to consider a sale as an opportunity to maximize returns.

Exit Strategy: For private equity firms or venture capital investors that have invested in the bank, a sale could be part of their exit strategy to realize gains on their investment within a certain timeframe.

The decision to sell a bank can be influenced by a combination of financial, strategic, regulatory, and market factors, as well as the objectives and priorities of the bank's stakeholders. Contact The Loan MarketPlace to discreetly discuss the potential sale of your bank or to purchase a bank. Let us present you options.