In today's dynamic banking landscape, efficiently managing loan portfolios and maximizing opportunities is crucial. When your bank decides to pass on a loan participation, referring that opportunity to The Loan MarketPlace can provide significant benefits. Here's why:

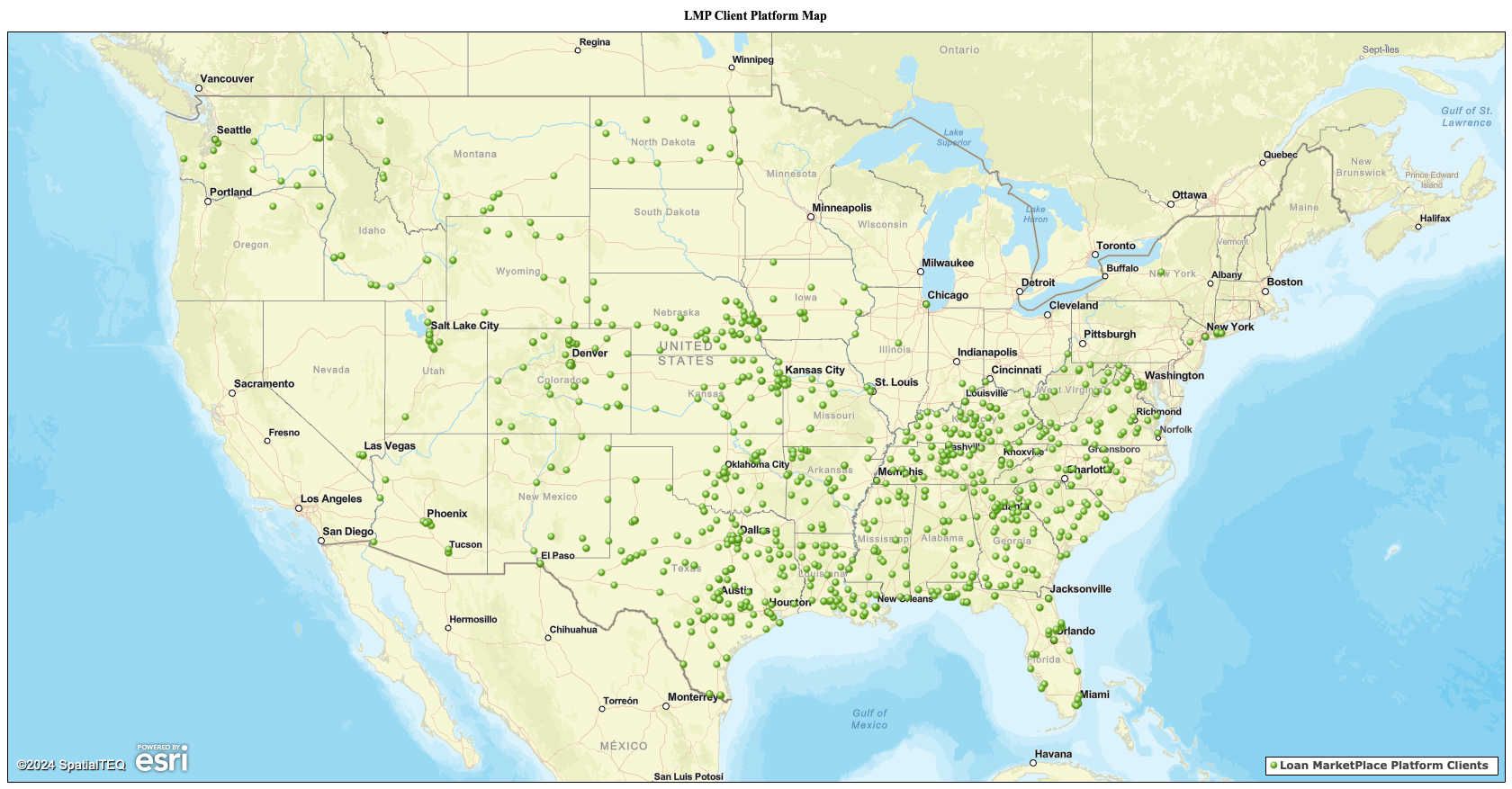

1. Unparalleled Network Reach: The Loan MarketPlace boasts a vast network of over 1,300 banks across the country. This extensive reach means that even if your institution isn't the right fit for a particular loan participation, there's a high probability that another bank in our network will be interested. By referring these opportunities, you're tapping into a diverse pool of potential buyers, increasing the chances of successful placement.

2. Impressive Success Rate: Our track record speaks for itself. With a remarkable 95% effective loan placement rate, The Loan MarketPlace has consistently demonstrated its ability to match loan participations with interested buyers. This high success rate means that when you refer an opportunity to us, you can be confident that it's likely to find a home, benefiting both the original lender and the participating institution.

3. Robust Platform for Seamless Transactions: Our state-of-the-art platform facilitates smooth, efficient transactions. It's designed to streamline the process of listing, discovering, and finalizing loan participations. This technological edge ensures that opportunities you refer are presented effectively to potential buyers, maximizing visibility, and increasing the likelihood of successful placement.

4. Valuable Market Insights: By leveraging our platform, you gain access to invaluable market trend information. Our unique position allows us to gather and analyze feedback from our extensive network and completed transactions. This data can provide your bank with insights into:

- Current market appetites for various loan types

- Pricing trends across different regions and loan categories

- Emerging opportunities in the loan participation market

These insights can inform your bank's strategy, even for loans you choose to keep on your books.

5. Strengthening Relationships: Referring loan participations to The Loan MarketPlace can help strengthen your relationships with other banks and borrowers. Even when you can't take on a participation yourself, you're still providing a valuable service by connecting the loan with our platform. This demonstrates your commitment to finding solutions for your clients, potentially leading to increased loyalty and future business opportunities.

6. Risk Mitigation: By referring loans to our diverse network, you're indirectly contributing to risk distribution across the banking system. This can lead to a more stable financial ecosystem, which benefits all participants in the long run.

7. Efficiency and Focus: Outsourcing the placement of loan participations you've passed on allows your team to focus on core activities and prioritize opportunities that align more closely with your current strategy. It's an efficient way to ensure that promising loans find a home without diverting your internal resources.

In an increasingly interconnected financial world, The Loan MarketPlace offers a powerful tool for banks to optimize their loan participation strategies. By referring loan participation opportunities to our platform, you're not just finding homes for individual loans – you're tapping into a wealth of market intelligence, expanding your network, and contributing to a more efficient, robust banking ecosystem.

Whether you're looking to offload risk, diversify your portfolio, or simply ensure that good opportunities don't go to waste, The Loan MarketPlace provides a reliable, efficient, and data-driven solution. Leverage our 95% placement rate, vast network, and market insights to turn passed opportunities into valuable connections and potential future collaborations.

Visit our website at www.theloanmp.com for more information and strategies to manage your loan portfolio. Consider giving me a call to discuss any loan participations or referrals you may have. We have built our business on referrals from bankers like you.