Unleashing Liquidity: A Deep Dive into Successful Loan Participation Sales Strategies for Banks

In the ever-evolving landscape of banking, liquidity remains a crucial factor for sustained growth and stability. One powerful avenue for enhancing liquidity is through strategic loan participation sales. This blog explores three highly effective strategies that banks can leverage to unlock liquidity and propel their financial success.

1. Diversification through Participation: The Power of Many

One key strategy for banks to enhance liquidity is through diversification achieved by participating loans. By forming strategic partnerships with other financial institutions, banks can spread the risk associated with a particular loan across multiple lenders. This not only reduces exposure but also allows banks to free up capital that can be used for new lending opportunities.

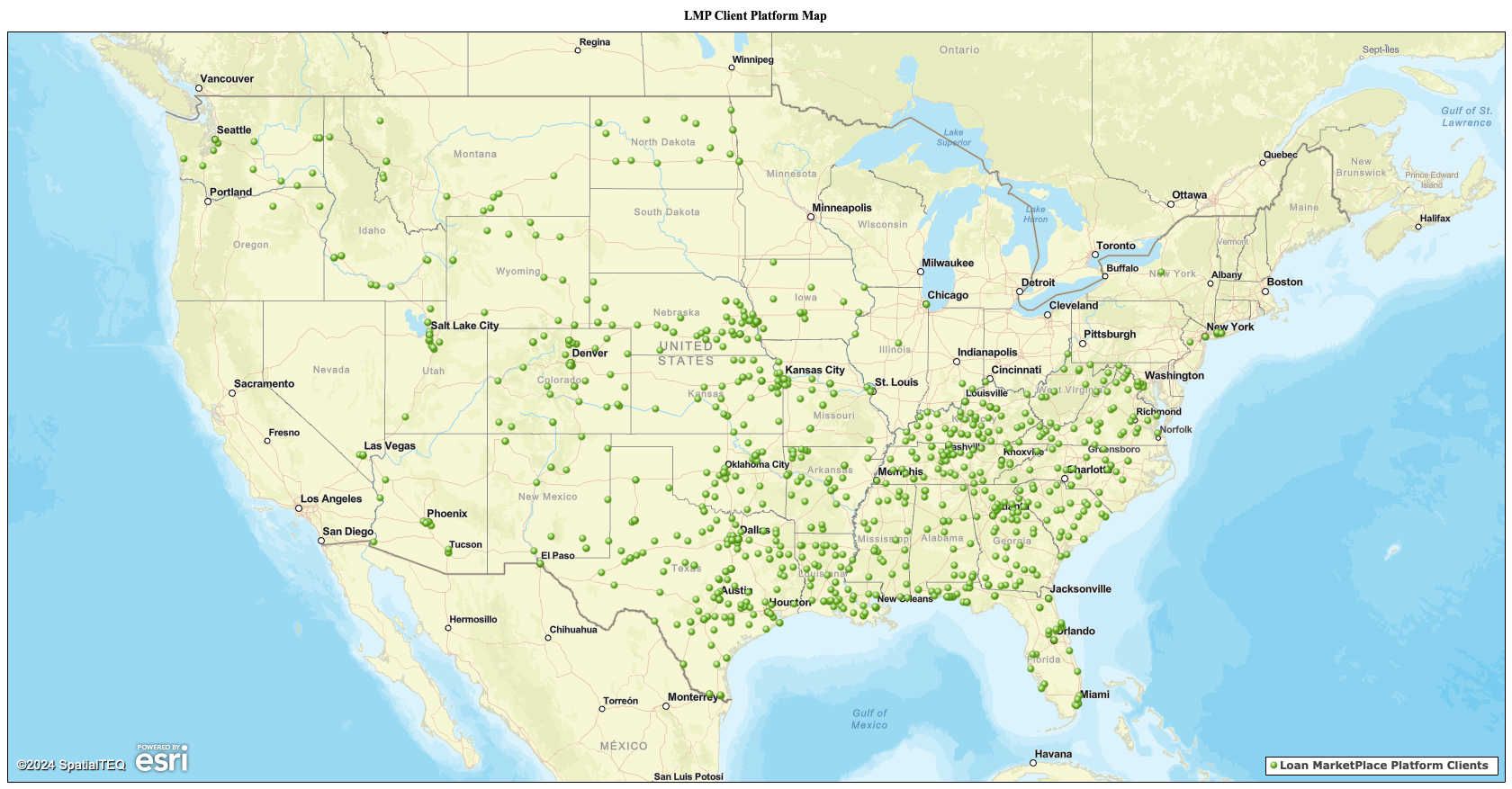

Additionally, participations open doors to a broader pool of potential borrowers, creating opportunities for market up to larger loans. This collaborative approach not only enhances liquidity but also fosters a network of partnerships thru The Loan MarketPlace that can prove valuable in the long run.

2. Technology-Driven Loan Sales Platforms: Efficiency Redefined

Embracing technology is no longer a choice but a necessity for banks aiming to thrive in the digital era. Utilizing advanced loan sales platforms can significantly enhance liquidity by streamlining the entire loan participation sales process. The Loan MarketPlace platform facilitates quick and efficient communications between participating banks, reducing the time it takes to close deals.

Automated workflows, real-time data analytics, and secure communication channels empower banks to make informed decisions swiftly. This not only accelerates the liquidity generation process but also positions your bank as leaders in the industry, attracting potential participants and more borrowers.

3. Strategic Portfolio Management: Optimizing Assets for Maximum Impact

Successful liquidity management involves a keen understanding of the bank's portfolio. By strategically managing loan portfolios, banks can identify opportunities to sell off portions of loans that may be less aligned with their overall strategy. This targeted approach allows banks to optimize their balance sheets and deploy capital more efficiently.

Regular assessments of the portfolio's risk-return profile enable banks to identify the right mix of loans for participation sales or purchases. This strategic portfolio management not only enhances liquidity but also positions the bank to capitalize on emerging market trends and capitalize on new growth opportunities.

In the dynamic world of banking, adaptability and strategic decision-making are paramount. Leveraging loan participation sales as a tool for enhancing liquidity requires a thoughtful approach that considers diversification, technology integrated platforms, and strategic portfolio management. By embracing these three effective strategies, banks can not only unlock liquidity but also position themselves as agile and forward-thinking institutions ready to thrive in the ever-evolving financial landscape.