Participations

Participations

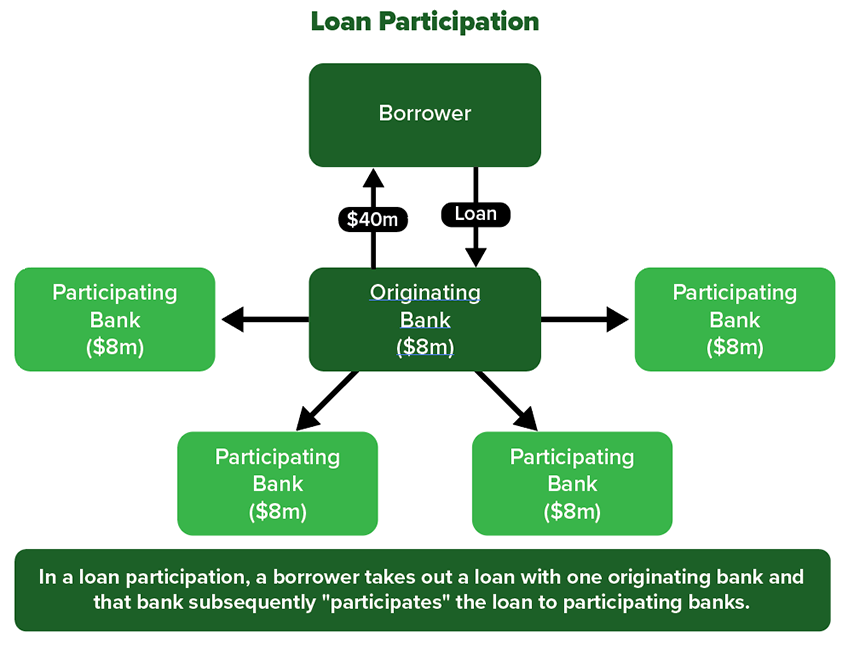

What is a loan participation?

- Loan participations are commonly used in commercial and corporate lending. They provide a way for banks to manage risk, diversify their portfolios, and meet the financing needs of their customers while complying with regulatory requirements. They can also be an efficient way for banks to deploy excess liquidity or enter new markets without originating loans entirely on their own.

- The decision to sell loan participations can depend on the originating institution's specific objectives, such as risk mitigation, regulatory compliance, balance sheet management, and income generation. Similarly, the purchasing institutions may have their own motivations for buying loan participations, such as portfolio diversification and access to new lending opportunities. The practice of selling and buying loan participations is a common and established part of the banking and lending industry.