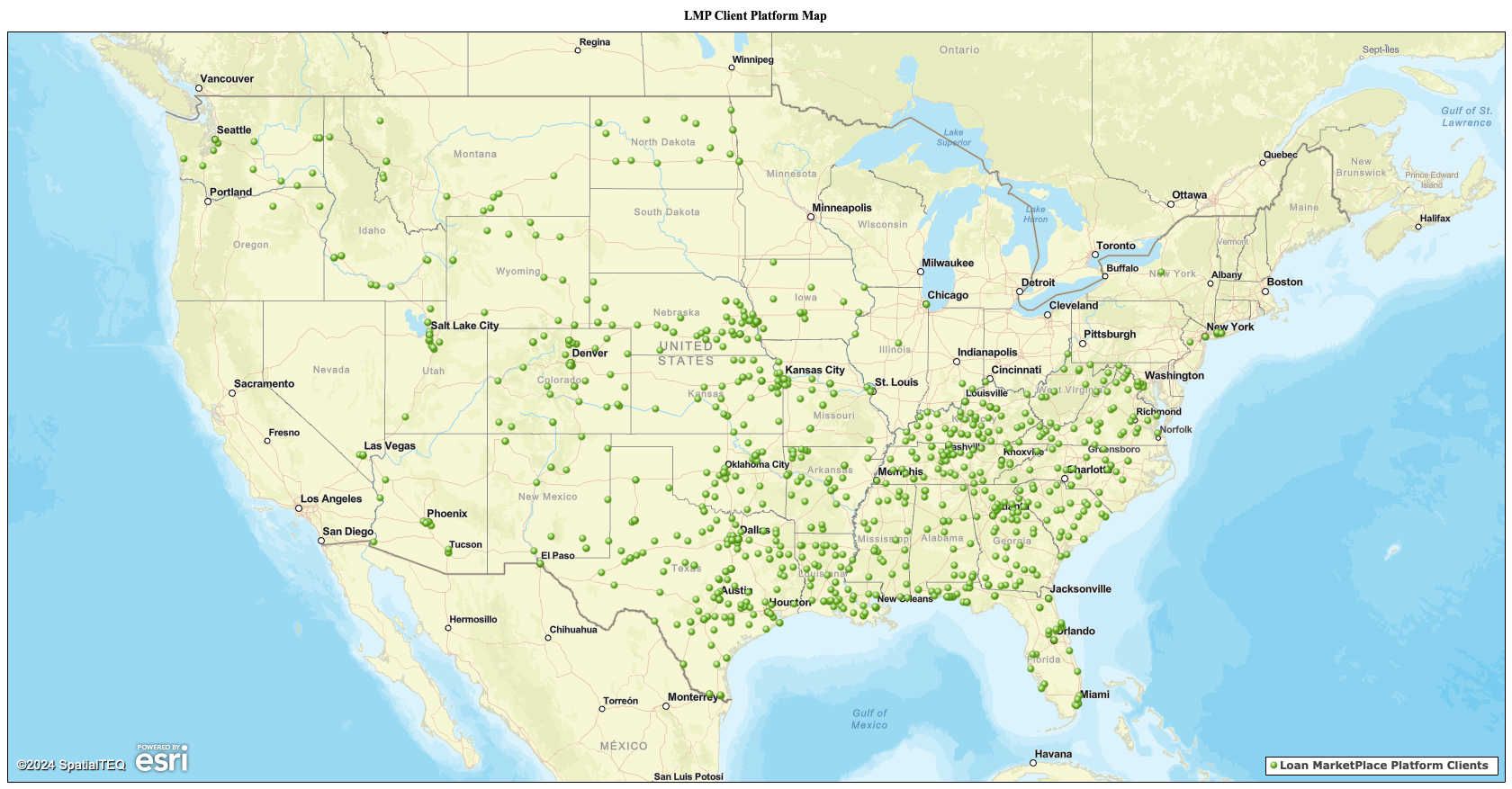

Fintech Platforms Facilitate Trading - The emergence of online fintech platforms like The Loan MarketPlace is making it easier than ever for banks and investors to connect and transact loan trades. Our digital marketplace provides an efficient way to anonymously list portions of loans for sale and receive responses from interested buyers. This streamlined process is helping unlock more supply and meet the growing investor demand.

Regulatory Capital Relief - For banks, selling loan participations is an effective way to optimize capital ratios by transferring some of the credit risk to investor partners. With tougher regulatory capital requirements in place, more institutions are embracing the loan participation market as a capital management tool to free up space on their balance sheets for additional lending.

Economic Outlook Remains Positive - Despite fears of a potential recession, the overall U.S. economic outlook still appears relatively healthy with solid GDP growth and low unemployment. This backdrop gives investors’ confidence to continue actively participating in corporate and commercial loan investments. Barring a severe downturn, we expect the bank participation market growth trajectory to remain firmly upwards through 2024.

Loan Demand Shifts - While loan demand is slowing in many parts of the country and in several product segments due to prolonged high rates, market saturation, and other local economic factors, banks with ample liquidity are keeping their "powder dry" to provide services to their core client base. Those with low organic demand are deploying liquidity into purchasing loan participations and pursuing niche, higher-yielding lending opportunities to offset lower yields from the past.

Underwriting Standards - We are seeing higher leverage ratios as the new standard in many of the loans listed on our platform. At the same time, banks buying participations have a clear appetite for high-quality, bank-originated loans at market rates, including those outside their typical geographic footprint. Well-underwritten loans remain in strong demand.

While loans always carry some inherent default risk, the ability to diversify that risk through co-lending programs is a win for both banks and yield-focused investors. With interest rates likely to stay elevated for the foreseeable future, the market forces driving loan participation trading volumes look poised to persist.

At The Loan MarketPlace, we focus on matching buyers and sellers of loans efficiently, creating opportunities for banks to make effective revenue and client care decisions. Contact us today to discuss your loan participation opportunities. We have lots of buyers in the market to purchase participations. Visit our website at www.theloanmp.com for more information.